Top Credit Card Mistakes You Should Avoid to Protect Your Financial Health

Smart Credit Card Habits Help Build Wealth — Avoid These Costly Pitfalls

Using A credit Card Can Be A Powerful Financial Tool — But Only When Used Wisely. Many Individuals Fall Into Traps That Damage Their Credit Score, Accrue unnecessary Interest, And Create Long-term Debt. Here Are The top Credit Card Mistakes You Should Avoid To Maintain financial Discipline And Stability.

⚠️ 1. Late Payments

Delaying Or Missing Your Credit Card Payment Invites penalties, Interest, And Credit Score Damage. Always Pay Your Bill On Time — Even Setting Up Auto-pay Is A Smart Move.

⚠️ 2. Only Paying The Minimum Due

Minimum Payments May Avoid Late Fees, But Your outstanding Balance Will Attract High-interest Rates (up To 40% Annually), Making It Harder To Clear The Debt In The Long Run.

⚠️ 3. Maxing Out The Credit Limit

Using More Than 30–40% Of Your Credit Limit Negatively Affects Your credit Utilization Ratio — A Key Factor In Determining Your CIBIL Or Experian Score.

⚠️ 4. Ignoring Interest Rates & Terms

Each Card Comes With Specific interest Rates, Due Dates, And Charges. Not Knowing These Can Cost You Dearly. Always Read Your Credit Card Statement Thoroughly.

⚠️ 5. Applying For Too Many Cards

Every New Application Triggers A hard Inquiry On Your Credit Report. Multiple Cards Also Increase The Chances Of Mismanagement And Debt Buildup.

⚠️ 6. Closing Old Cards Impulsively

Older Cards Help Build A Longer Credit History — An Essential Component Of A Good Credit Score. Close Cards Only If Necessary And Avoid Doing So Right After Paying Off Balances.

⚠️ 7. Not Reporting Lost Or Stolen Cards

Delay In Reporting A Lost Credit Card Can Result In Fraudulent Charges And Huge Losses. Use Mobile Banking Or Call Customer Service Immediately.

✅ Smart Tip From THE JANTA VOICE

Use Your Credit Card Like a Debit Card With Benefits — Spend Only What You Can Repay, And Enjoy Rewards, Cashback, And Credit-building Advantages Without Falling Into Debt Traps.

Stay Tuned To THE JANTA VOICE For More Tips On personal Finance, Credit Card Best Practices, And Responsible Money Management.

Our Newsletter

Subscribe our newsletter to get latest news & promotion

By subscribing, you accepted the our Policy

Others Post

![Download the Ultimate Marriage & Relationship Documents Kit – All Legal & Personal Templates in On [...]](https://thejantavoice.com/webcontent/blog/6839716aeca5c53.png)

Download the Ultimate Marriage & Relationship Documents Kit – All Legal & Personal Templates in On [...]

SEBI’s New Rules May Hit ₹35,000 Crore Structured Products Market

BAT Sells ₹12,100 Crore Stake in ITC via Block Deal, Retains Majority Holding

BAT Sells ₹12,100 Crore Stake in ITC via Block Deal, Retains Majority Holding

India’s New Sodium-Ion Battery Charges 80% in 6 Minutes, Promises Breakthrough [...]

India’s New Sodium-Ion Battery Charges 80% in 6 Minutes, Promises Breakthrough for EVs

Mohanlal & Prabhas Charged No Fee for ‘Kannappa’, Confirms Vishnu Manchu

Suniel Shetty Recalls Abusing Gangster Hemant Pujari After Threats to His Father

Suniel Shetty Recalls Abusing Gangster Hemant Pujari After Threats to His Father

Akshay Kumar Sends ₹25 Crore Legal Notice to Paresh Rawal Over Hera Pheri 3 Ex [...]

Akshay Kumar Sends ₹25 Crore Legal Notice to Paresh Rawal Over Hera Pheri 3 Exit

How 0% Interest Credit Cards Can Help You Save and Pay Off Debt Faster

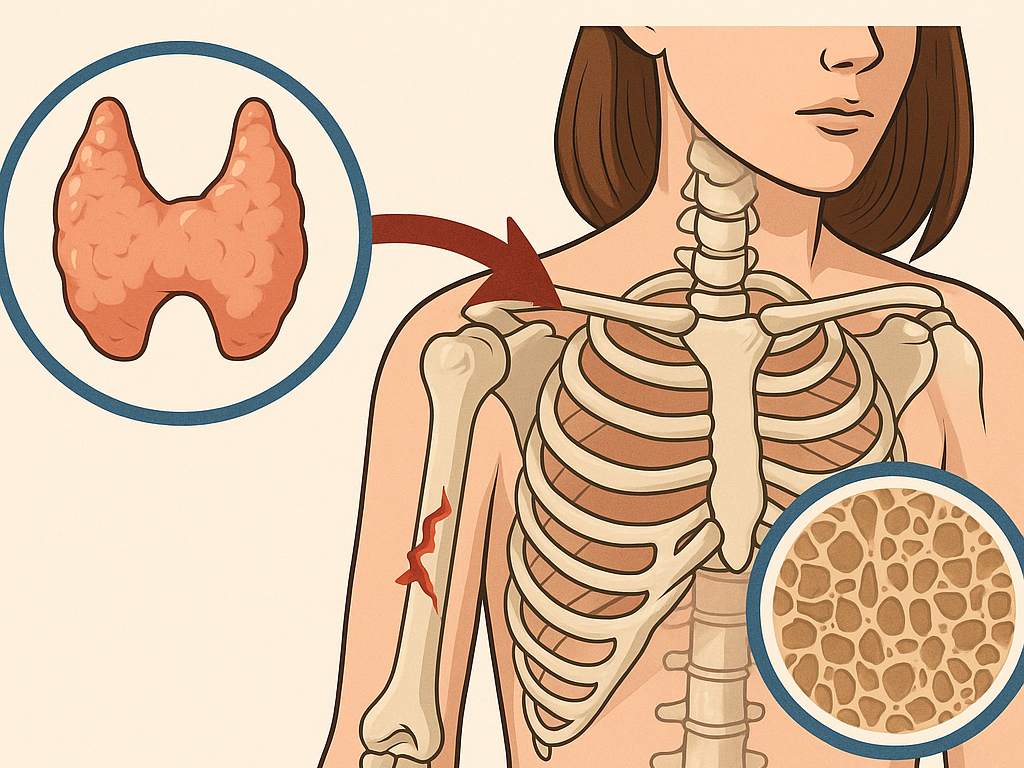

Why Women With Hypothyroidism Have a Higher Risk of Bone Fractures and Osteoporosis

India Lost Fighter Jets in Clash with Pakistan: Defence Chief Confirms

Delhi High Court Orders YouTuber Mohak Mangal to Remove Defamatory ANI Video Con [...]

Delhi High Court Orders YouTuber Mohak Mangal to Remove Defamatory ANI Video Content

India Targets Guarded Complex in Pakistan’s Murid Airbase, Satellite Image Con [...]

India Targets Guarded Complex in Pakistan’s Murid Airbase, Satellite Image Confirms

Daylight Found to Strengthen Immune Response Against Infections, Study Shows

Mumbai Waterlogged After Heavy Rains, IMD Issues Yellow Alert for City and Surrounding Areas

Fake Doctor in Jabalpur Exposed After 7 Years; Used Friend’s Documents for MBB [...]

Fake Doctor in Jabalpur Exposed After 7 Years; Used Friend’s Documents for MBBS Admission

Tej Pratap Yadav Expelled from RJD Amid Divorce Case and Viral Photos with Girlf [...]

Tej Pratap Yadav Expelled from RJD Amid Divorce Case and Viral Photos with Girlfriend

Influencer Sharmistha Panoli Arrested Over Operation Sindoor Remarks: What We Know So Far

Kush Maini Makes History as First Indian to Win Formula 2 Race in Monaco

Microsoft Launches NLWeb to Help Turn Any Website Into an AI App

Best Standard Bikes to Ride in Siliguri – Comfort, Power & Value

Pakistan PM Trolls Himself by Gifting Edited Chinese Rocket Drill Photo as Attack on India

Russia Attacks Kyiv with Drones, Injures Civilians and Sparks Fires in Residenti [...]

Russia Attacks Kyiv with Drones, Injures Civilians and Sparks Fires in Residential Areas

Russia Captures 3 More Ukrainian Settlements Amid Eastern Offensive

Russia Captures 3 More Ukrainian Settlements Amid Eastern Offensive

0 comments

Share